Our Process

The name Renaissance evokes the spirit of an age where the interdependence of art and science first emerged. It also defines our approach to investing, which is built on a foundation of quantitative disciplines, but guided by experience and judgment.

Renaissance believes that systematic analysis combined with consistent implementation leads to superior investment results. Our research efforts are geared toward sifting through the torrent of information flowing from today’s financial markets and identifying only the most meaningful items for further review and study. This disciplined approach ensures that our research effort is focused, direct and meaningful.

Applying the results of this research effort in a consistent manner ensures that our portfolios always reflect our current analysis of investment opportunities and risk, and that client portfolios reflect these efforts on an ongoing basis.

The foundation of the Renaissance investment process is our proprietary quantitative modeling, employing factors that we regularly test and validate for effectiveness. This modeling process allows us to systematically identify the most quantitatively attractive stocks in the market. Once we have identified a subset of companies that are candidates for inclusion in one of our portfolios, we subject each purchase candidate to an intensive fundamental review process, drawing upon our experience and judgment to select only the most attractive stocks for our portfolios. We believe that this combination of quantitative analysis with human judgment and experience is the basis for our performance track record.

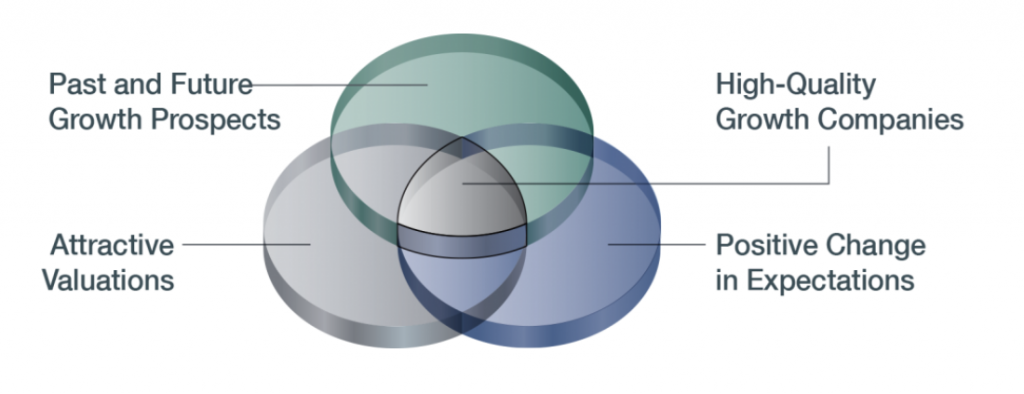

In evaluating candidate companies for ownership, Renaissance is looking for three key attributes: 1) Strong growth characteristics; 2) A high degree of earnings momentum; and 3) A reasonable valuation for the company.